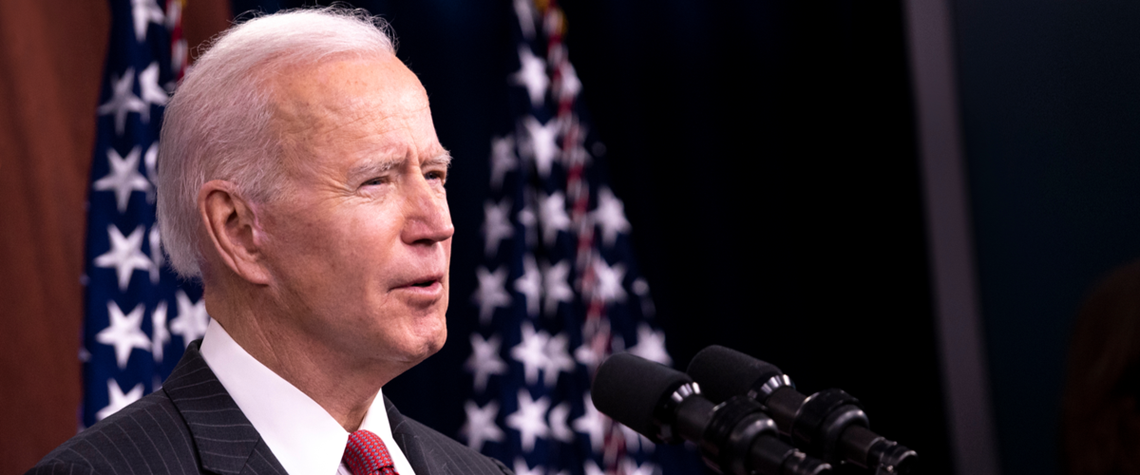

Biden announces oil reserve release

Washington will take 1mn bl/d from SPR for the next six months

President Biden has announced that the US will release 1mn bl/d from its Strategic Petroleum Reserve (SPR) for the next six months, adding a total 180mn bl to the market over the period. “This is a wartime bridge to increase oil supply until production ramps up later this year. And it is by far the largest release from our national reserve in our history,” Biden said in a speech. The release is being “coordinated... with allies and partners around the world”, the president continued, adding that “we have commitments from other countries to release tens of millions of additional barrels into the market”. “I want to acknowledge those companies that have already announced they are increasing im

Also in this section

15 August 2025

US secondary sanctions are forcing a rapid reassessment of crude buying patterns in Asia, and the implications could reshape pricing, freight and supply balances worldwide. With India holding the key to two-thirds of Russian seaborne exports, the stakes could not be higher

11 August 2025

The administration is pushing for deregulation and streamlined permitting for natural gas, while tightening requirements and stripping away subsidies from renewables

8 August 2025

The producers’ group missed its output increase target for the month and may soon face a critical test of its strategy

7 August 2025

The quick, unified and decisive strategy to return all the barrels from the hefty tranche of cuts from the eight producers involved in voluntary curbs signals a shift and sets the tone for the path ahead