US SPR takes on new role

Strategic stocks have become as much a market management tool as a security of supply buffer, and this new tactic is likely to continue beyond the next election

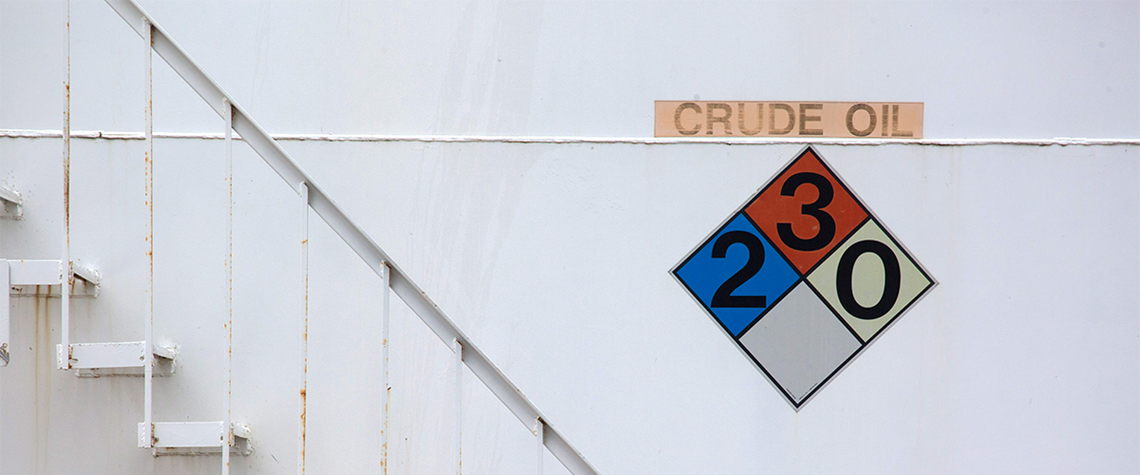

The purpose and optimal size of the US Strategic Petroleum Reserve (SPR) has become the subject of debate since the Biden administration adopted an at-least implicit price band mechanism for withdrawals from and refills of the reserve in 2022. The US Department of Energy (DOE) released more than 220m bl from the SPR in 2022 to combat a 50% jump in benchmark light crude prices—to $120/bl—due to actions associated with Russia’s invasion of Ukraine in February of that year (see Fig.1). The initial 180m bl—released under IEA obligation, unlike the remainder—fetched an average price of $95/bl, suggesting an implicit top to the price band. A

Also in this section

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis