US SPR takes on new role

Strategic stocks have become as much a market management tool as a security of supply buffer, and this new tactic is likely to continue beyond the next election

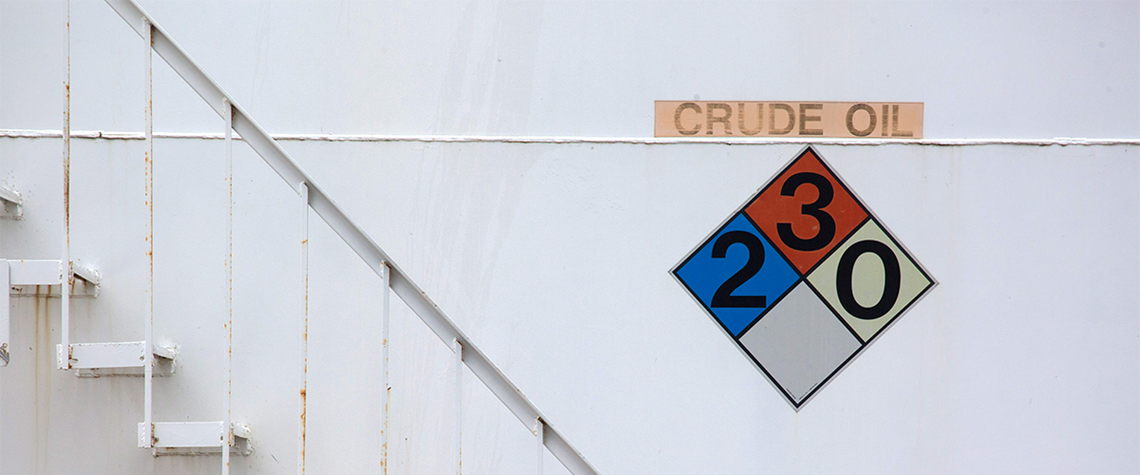

The purpose and optimal size of the US Strategic Petroleum Reserve (SPR) has become the subject of debate since the Biden administration adopted an at-least implicit price band mechanism for withdrawals from and refills of the reserve in 2022. The US Department of Energy (DOE) released more than 220m bl from the SPR in 2022 to combat a 50% jump in benchmark light crude prices—to $120/bl—due to actions associated with Russia’s invasion of Ukraine in February of that year (see Fig.1). The initial 180m bl—released under IEA obligation, unlike the remainder—fetched an average price of $95/bl, suggesting an implicit top to the price band. A

Also in this section

5 August 2025

After failed attempts to find a buyer for its stake in Russia’s largest oil producer, BP may be able to avoid the harsh treatment meted out to ExxonMobil and Shell when they exited—and could even restart operations if geopolitical conditions improve

1 August 2025

A number of companies have filed arbitration claims against Gazprom over non-deliveries of contracted gas or other matters—and won. The next step is to collect the award, but this is no easy task

1 August 2025

Europe’s refining sector is desperately trying to adapt to a shifting global energy landscape and nowhere is this more apparent than in its largest economy

1 August 2025

The Middle East natural gas playbook is being rewritten. The fuel source offers the region a pathway to a cleaner, sustainable and affordable means of local power, to fasttrack economic development and as a lucrative opportunity to better monetise its energy resources.