Eco Atlantic sees promise on the frontiers

The independent tells Petroleum Economist it sees further opportunities in Guyana, South Africa and Namibia

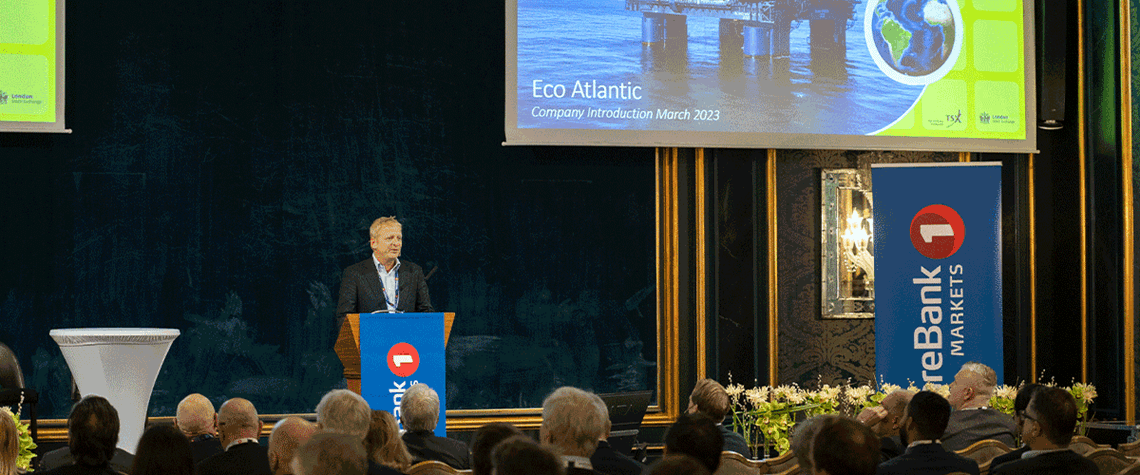

Toronto- and London-listed independent Eco Atlantic is in the uniquely positive position of holding acreage in arguably the world’s three most promising oil and gas frontiers: Guyana, South Africa and Namibia. CEO Gil Holzman spoke with Petroleum Economist about the company’s plans. The Gazania well on South Africa’s 2B block was a disappointment due to the lack of commercial discovery, but those efforts “in a sense also paved the way for other Orange basin developments”, says Holzman, who goes on to emphasise that Eco Atlantic managed to deliver the test drilling on time and on budget, while meeting South Africa’s strict environmental approval and community engagement stipulations. There is

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way