US oil and gas output on the rise

Surging crude prices prompted increased drilling activity last year, but debt and financing issues constrained growth

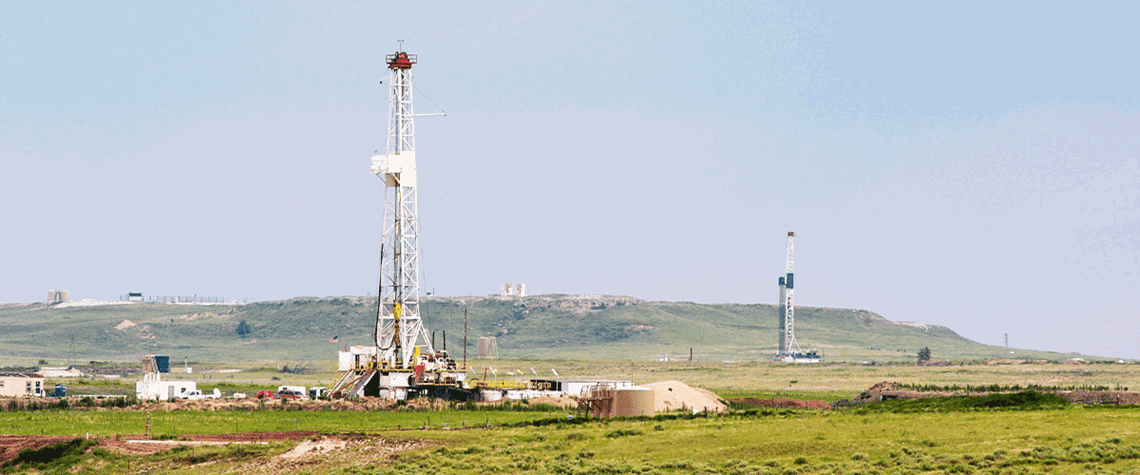

Drilling activity in the US increased by 51.3pc on an average yearly basis in 2022, driving crude production up to 11.9mn bl/d and marking a 6.4pc increase compared with the 11.2mn bl/d averaged in 2021. The increased output was augmented by US companies completing a large backlog of drilled-but-uncompleted (Duc) wells in two major oil shale basins. WTI started 2022 at $83.22/bl and climbed steadily throughout the year, despite rising interest rates, fears of economic recession and restricted Russian supply caused by the war in Ukraine. Crude prices hit a 15-year high in June 2022, at $114.84/bl, before falling back down and ending the year at $76.44/bl. The surge in commodity prices caused

Also in this section

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis