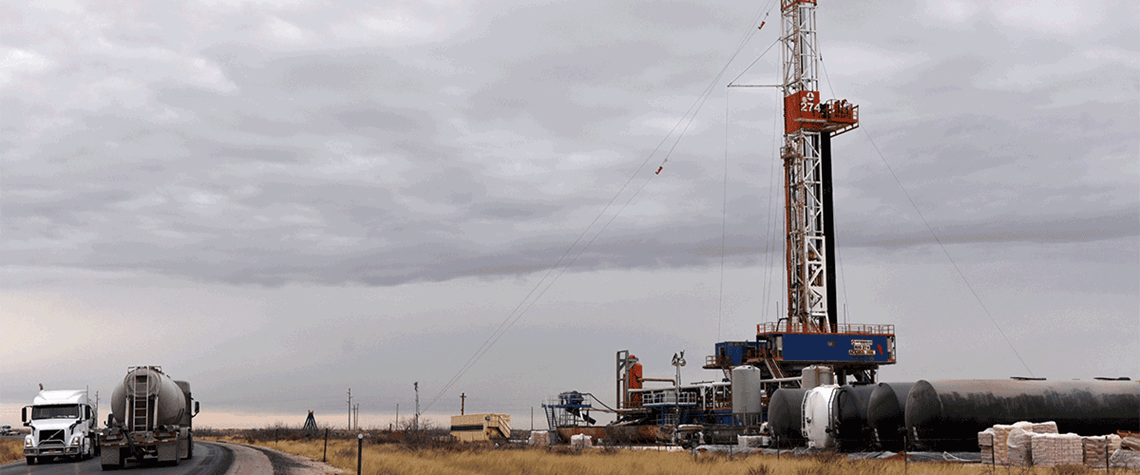

US shale response to oil price boost may be muted

Behind the rig count data lie differences between public and private operators, acreage questions, the lure of returns and unwavering capital discipline

The US’ active oil and gas rig count has generally been trending downwards since the end of April even as crude prices have been creeping up in recent weeks after holding relatively steady earlier in the year. The combined oil and gas rig count fell from 755 on 28 April to 641 on 15 September, according to Baker Hughes, with oil-focused rigs declining from 591 to 515. However, the Baker Hughes data from the latest three weeks in that period suggest the decline may be turning, with the total count falling by only one, to 631, with the total count fluctuating between 632 and 631 for three weeks before rising to 641, though it remains to be seen whether this will hold. Oil rig counts typically

Also in this section

23 February 2026

The country’s upstream players have demonstrated resilience to low oil prices and are well positioned to prosper despite a volatile market

20 February 2026

The country is pushing to increase production and expand key projects despite challenges including OPEC+ discipline and the limitations of its export infrastructure

20 February 2026

Europe has transformed into a global LNG demand powerhouse over the last few years, with the fuel continuing to play a key role in safeguarding the continent’s energy security, Carsten Poppinga, chief commercial officer at Uniper, tells Petroleum Economist

20 February 2026

Sempra Infrastructure’s vice president for marketing and commercial development, Carlos de la Vega, outlines progress across the company’s US Gulf Coast and Mexico Pacific Coast LNG portfolio, including construction at Port Arthur LNG, continued strong performance at Cameron LNG and development of ECA LNG