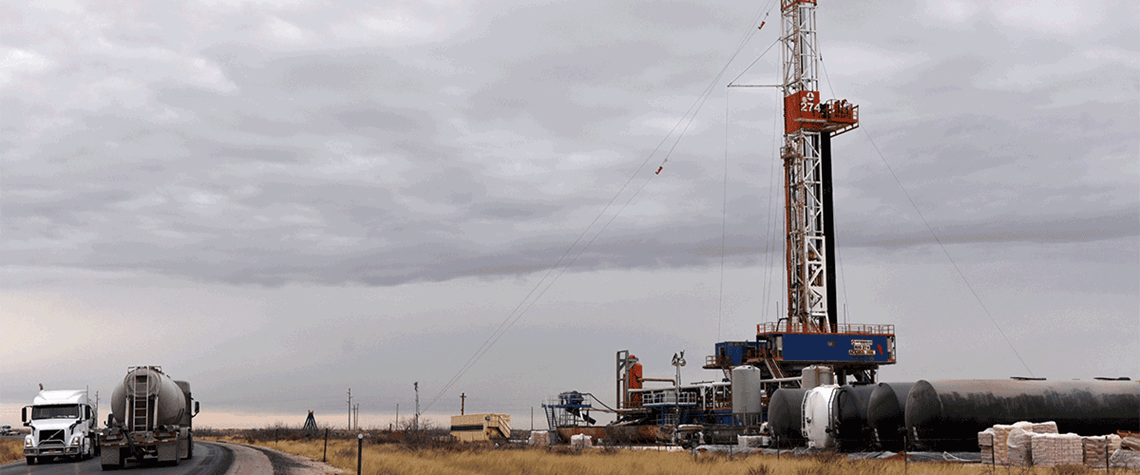

US shale response to oil price boost may be muted

Behind the rig count data lie differences between public and private operators, acreage questions, the lure of returns and unwavering capital discipline

The US’ active oil and gas rig count has generally been trending downwards since the end of April even as crude prices have been creeping up in recent weeks after holding relatively steady earlier in the year. The combined oil and gas rig count fell from 755 on 28 April to 641 on 15 September, according to Baker Hughes, with oil-focused rigs declining from 591 to 515. However, the Baker Hughes data from the latest three weeks in that period suggest the decline may be turning, with the total count falling by only one, to 631, with the total count fluctuating between 632 and 631 for three weeks before rising to 641, though it remains to be seen whether this will hold. Oil rig counts typically

Also in this section

25 July 2025

Mozambique’s insurgency continues, but the security situation near the LNG site has significantly improved, with TotalEnergies aiming to lift its force majeure within months

25 July 2025

There is a bifurcation in the global oil market as China’s stockpiling contrasts with reduced inventories elsewhere

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand