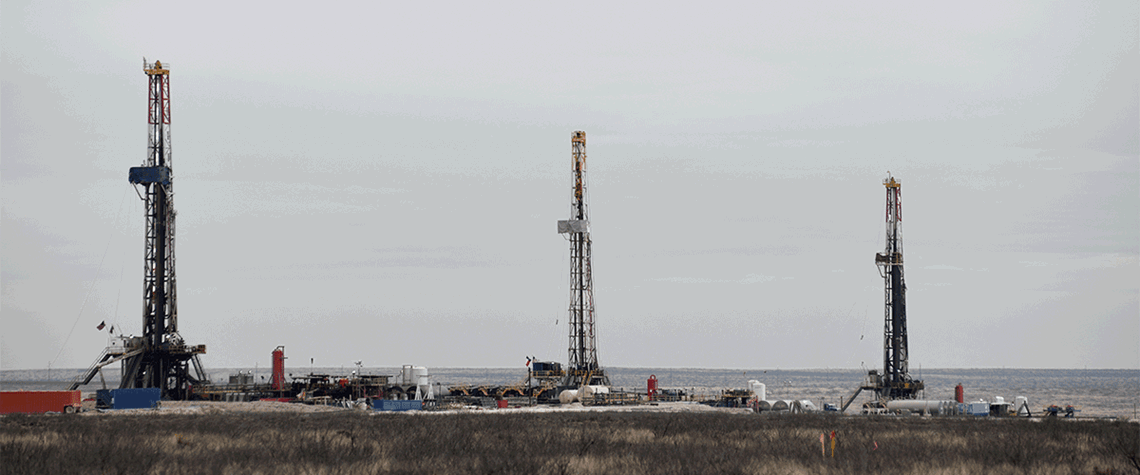

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

26 February 2026

OPEC, upstream investors and refiners all face strategic shifts now the Asian behemoth is no longer the main engine of global oil demand growth

25 February 2026

Tech giants rather than oil majors could soon upend hydrocarbon markets, starting with North America

25 February 2026

Capex is concentrated in gas processing and LNG in the US, while in Canada the reverse is true

25 February 2026

The surge in demand for fuel and petrochemical products in Asia has led to significant expansion in refining and petrochemicals capacities, with India and China leading the way