Shell demonstrates renewed focus on hydrocarbons

Gulf of Mexico moves suggest cautious optimism in region’s deep waters, with a shift to work smarter and balance risks

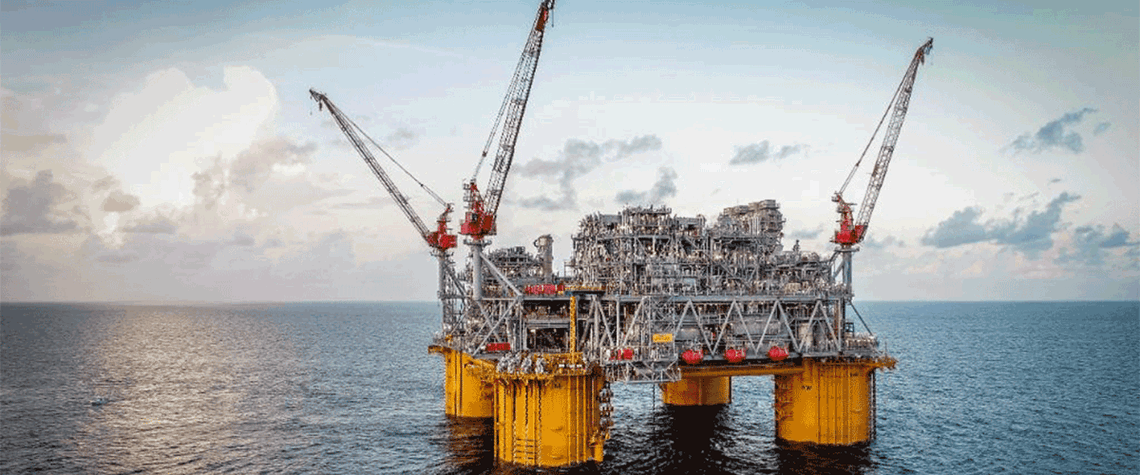

Two FIDs in quick succession by Shell in the US Gulf of Mexico (GOM) demonstrate the major’s renewed focus on oil and gas. In mid-December, Shell announced an FID on a phased campaign to add three wells in the Great White unit, boosting production at the company’s Perdido spar. This was followed later in December by the announcement that Shell and partner Norway’s Equinor had taken FID on Sparta, which will be Shell’s 15th deepwater platform in the GOM. The FIDs also illustrate the continuing trends in deepwater drilling. Some operators have remained hesitant to pursue new deepwater exploration, opting instead to expand production at existing platforms by drilling new wells in already produc

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation