LNG market stress to persist for years

But a supply glut could be coming later this decade

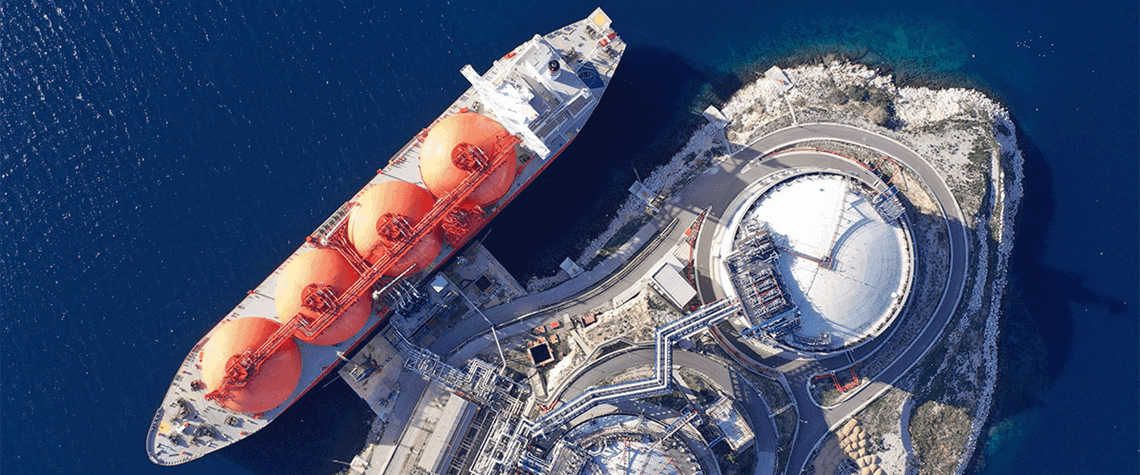

Europe’s attempts to substitute Russian pipeline gas with seaborne LNG upended the whole sector in 2022, resulting in record price spikes and significant uncertainty ahead of the heating season. Europe prepared by filling gas storage sites, reducing demand and aggressively rolling out new LNG import infrastructure. Nevertheless, there were fears the bloc would find itself short of energy, and that would likely have caused another surge in LNG prices, with knock-on effects for competing Asian buyers. Instead, the global gas markets narrowly avoided a serious supply crunch this winter, aided by milder-than-usual temperatures across the northern hemisphere and muted Chinese demand. But the gas

Also in this section

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis

2 March 2026

A potential blockade of the Strait of Hormuz following the escalating US-Iran conflict risks disrupting Qatari LNG exports that underpin global gas markets, exposing Asia and other markets to sharp price spikes, cargo shortages and renewed reliance on dirtier fuels