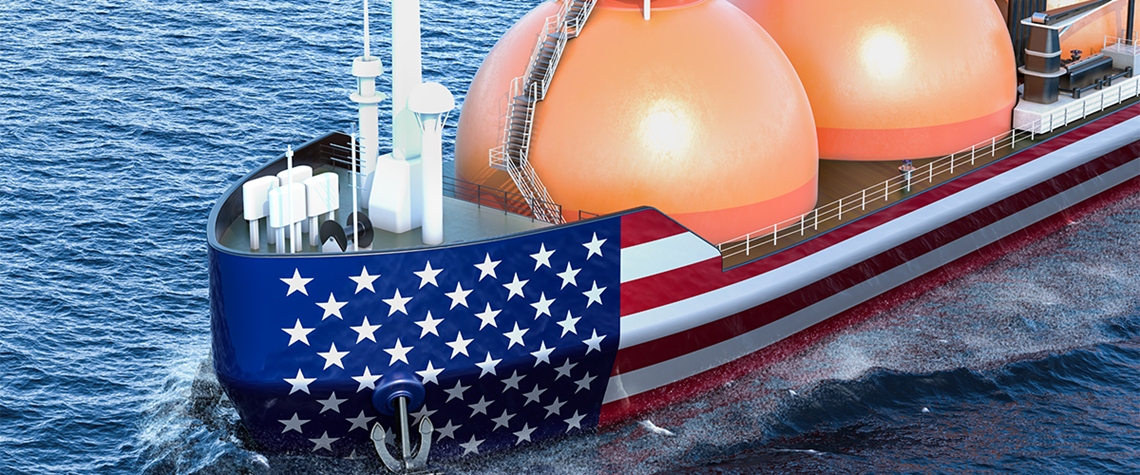

Will US LNG stampede lead to costly overbuild?

The US’ emergence as the world’s largest LNG producer is good news for gas-hungry Europe, but the project pipeline raises questions about how much capacity will be needed

The US was shaping up to become the world’s largest LNG producer last year, until an explosion in June put its second-largest liquefaction plant out of action. With the 15mn t/yr Freeport LNG having resumed production early this year—amid a welter of regulatory oversight and intervention—2023 now looks like the year in which the US will lift the trophy. It certainly has the capacity to do so. Since the first LNG cargo from the Lower 48 states left Houston-headquartered Cheniere Energy’s Sabine Pass project in 2016, another six projects have started up (see Fig.1). Together, they give the US an aggregate nameplate capacity of 91.3mn t/yr, significantly more than Qatar’s 77.4mn t/yr and just a

Also in this section

4 March 2026

The continent’s inventories were already depleted before conflict erupted in the Middle East, causing prices to spike ahead of the crucial summer refilling season

4 March 2026

The US president has repeatedly promised to lower gasoline prices, but this ambition conflicts with his parallel aim to increase drilling and could be upended by his war against Iran

4 March 2026

With the Strait of Hormuz effectively closed following US-Israel strikes and Iran’s retaliatory escalation, Fujairah has become the region’s critical pressure release valve—and is now under serious threat

3 March 2026

The killing of Iran’s Supreme Leader Ayatollah Khamenei in US–Israeli strikes marks the most serious escalation in the region in decades and a bigger potential threat to the oil market than the start of the Russia-Ukraine crisis