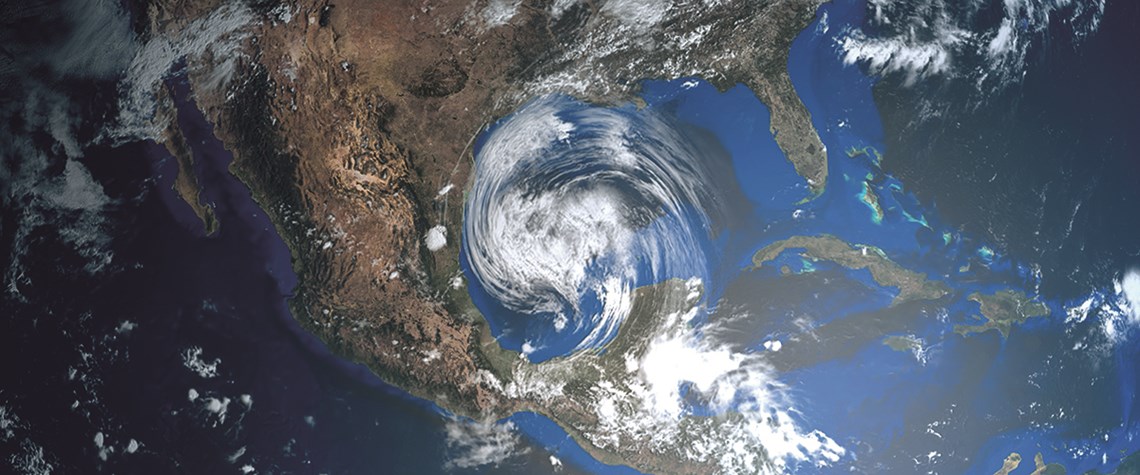

Harvey's aftermath

The Gulf Coast is now a force on global oil and gas markets, making the hurricanes that regularly ravage the region a greater threat to supply

The flooding has finally receded. The cleanup has begun. Houston, America's oil capital, and much of Texas will be counting the cost of Hurricane Harvey in the months and years to come. Energy markets too are taking stock of the damage. Harvey took aim at the heart of the American energy complex, which has undergone a building boom since the last major storm hit the region a decade ago. Billions of dollars have been spent on new pipelines, pumping stations, refining facilities, ports, liquefied natural gas export plants and oilfields to link surging output with markets at home and abroad. It has turned the Gulf Coast into a vital hub of production and refining for the global oil and gas trad

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation