21 March 2018

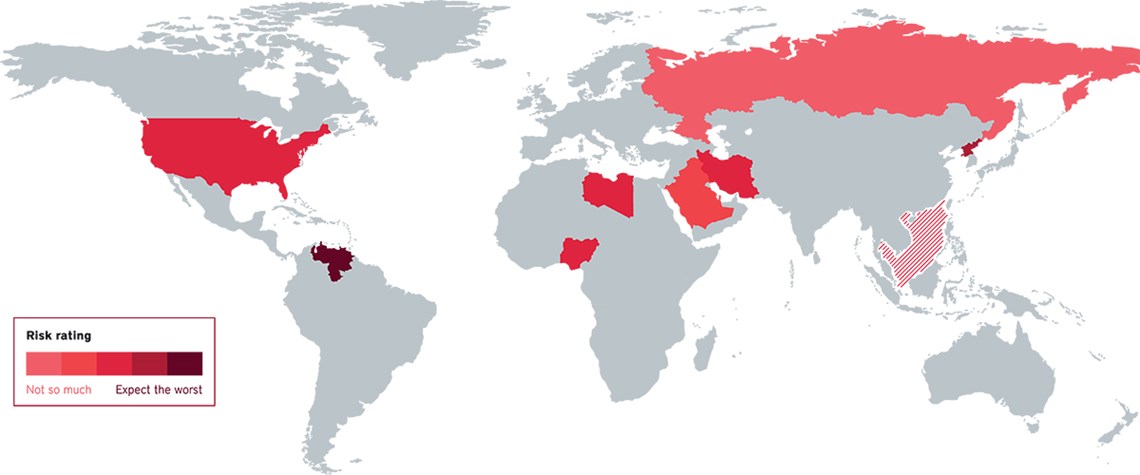

The volatile 10

As the oil market regains balance, risk will affect the price. Here's where to watch

US Unpredictable leader? Global risk now emanates directly from the Oval Office and—on everything from North Korea to Nafta—Donald Trump's Twitter account. For the oil market, the president is broadly bullish. US tax cuts may feed into higher demand; Trump's dislike of the Iran deal and stance on Venezuela may bring sanctions; and an implicit soft-dollar policy could support oil prices. His "American first" programme has not caused the drop in global trade some feared. The main bearish risk from the US comes from the Fed's planned interest-rate rises this year and the impact on the global economy. If Democrats win bigly in November's midterm elections, Trump will be stymied and the Russia in

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation