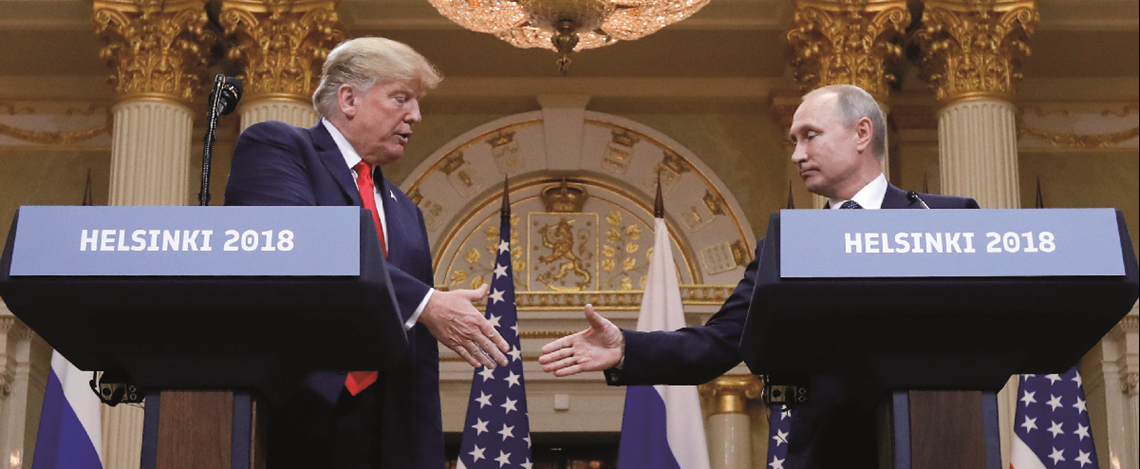

Will new sanctions trigger a Russian recession?

With the economy already wobbling, further curtailment of investment in energy and other sectors would spell trouble

A further wave of US sanctions may spark a Russian recession, even though oil, income from which represents 40% of federal budget revenues, is trading at its highest level in more than four years. Russia has been able to weather sanctions imposed over the Kremlin's annexation of Crimea in 2014 largely because of the collapse in the rouble, which has greatly boosted export revenues. Oil producers have also mitigated the impact of sanctions by partly replacing Western sources of funding with domestic and Asian capital, as well as attempting to develop their own technology for shale, offshore and Artic deposits. However, new legislation from the US-dubbed the "sanctions bill from hell"-could se

Also in this section

20 February 2026

The country is pushing to increase production and expand key projects despite challenges including OPEC+ discipline and the limitations of its export infrastructure

20 February 2026

Europe has transformed into a global LNG demand powerhouse over the last few years, with the fuel continuing to play a key role in safeguarding the continent’s energy security, Carsten Poppinga, chief commercial officer at Uniper, tells Petroleum Economist

20 February 2026

Sempra Infrastructure’s vice president for marketing and commercial development, Carlos de la Vega, outlines progress across the company’s US Gulf Coast and Mexico Pacific Coast LNG portfolio, including construction at Port Arthur LNG, continued strong performance at Cameron LNG and development of ECA LNG

19 February 2026

US LNG exporter Cheniere Energy has grown its business rapidly since exporting its first cargo a decade ago. But Chief Commercial Officer Anatol Feygin tells Petroleum Economist that, as in the past, the company’s future expansion plans are anchored by high levels of contracted offtake, supporting predictable returns on investment