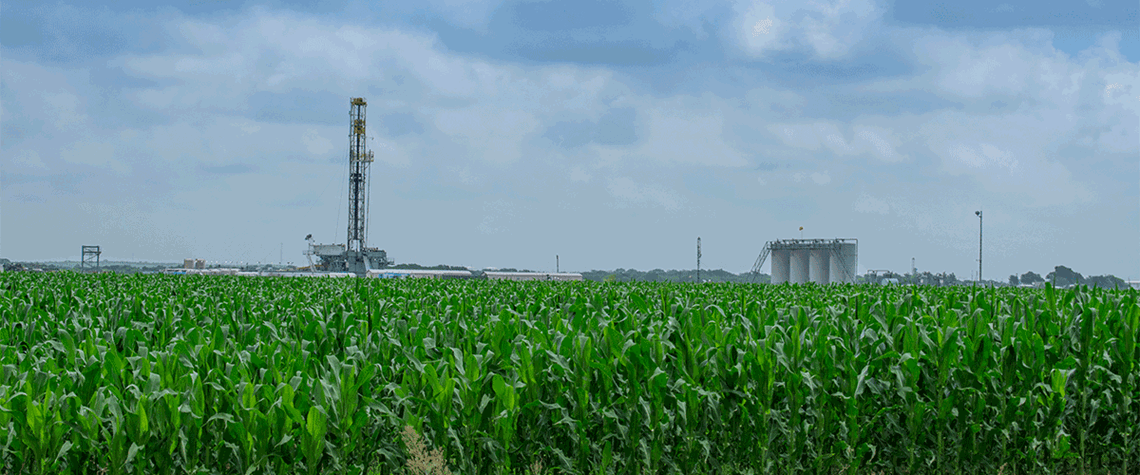

Consolidation heats up for maturing US shale

Growth might not be on the table, but operators are eyeing opportunities to add quality acreage

Lack of midstream capacity and dismal upstream growth prospects for 2023 are proving no barrier to M&A activity for maturing US shale basins. Over the past quarter, both the Eagle Ford and Appalachia recorded bumper deals that showcase the perceived long-term potential among operators. In the Eagle Ford, US independent Devon Energy snapped up Texas-focused Validus Energy for $1.8bn last year. The deal doubled the firm’s production base in the basin and increased exposure and access to Gulf Coast pricing. In July, the operator also added a bolt-on acquisition in the Williston basin but stressed there was not likely to be further spending in the immediate future. Other operators soon fo

Also in this section

27 February 2026

LNG would serve as a backup supply source as domestic gas declines and the country’s energy system comes under stress during periods of low hydropower output and high energy demand

27 February 2026

The assumption that oil markets will re-route and work around sanctions is being tested, and it is the physical infrastructure that is acting as the constraint

27 February 2026

The 25th WPC Energy Congress to take place in tandem as part of a coordinated week of high-level ministerial, institutional and industry engagements

27 February 2026

The deepwater sector must be brave by fast-tracking projects and making progress to seize huge offshore opportunities and not become bogged down by capacity constraints and consolidation