More to come in Thailand for Valeura

The Canadian indie is already undergoing rapid growth and is looking for further opportunities in the Southeast Asian country

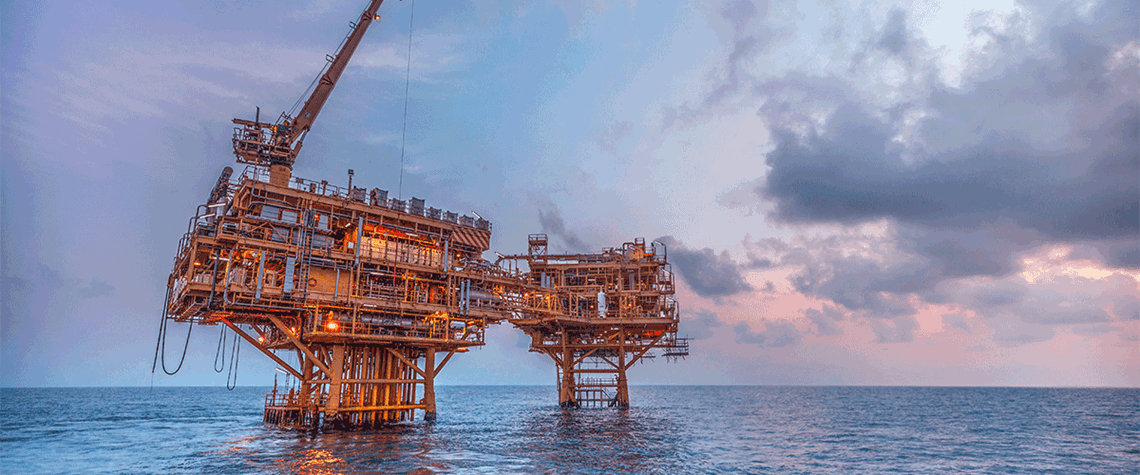

Calgary-based Valeura recently signed a “transformative” SPA with Abu Dhabi’s Mubadala for the state-owned investor’s entire upstream oil portfolio in Thailand. The Canadian independent expects the deal to close this quarter, CEO Sean Guest tells Petroleum Economist. At the time of the deal, the assets’ production totalled “approximately 21,000bl/d from three separate fields”, comprising Jasmine, Manora and Nong Yao, which are in the “mid-to-late” periods of their operational lifespans, explains Guest. “There is still growth potential within this portfolio,” he continues. “While we expect a slow decline in production from the large fields like Jasmine and Manora, we still have the Nong Yao f

Also in this section

25 July 2025

Mozambique’s insurgency continues, but the security situation near the LNG site has significantly improved, with TotalEnergies aiming to lift its force majeure within months

25 July 2025

There is a bifurcation in the global oil market as China’s stockpiling contrasts with reduced inventories elsewhere

24 July 2025

The reaction to proposed sanctions on Russian oil buyers has been muted, suggesting trader fatigue with Trump’s frequent bold and erratic threats

24 July 2025

Trump energy policies and changing consumer trends to upend oil supply and demand